Want to move to Europe? Digital nomad visas, real mobility, and the fine print everyone ignores

The Nomag Pulse #37

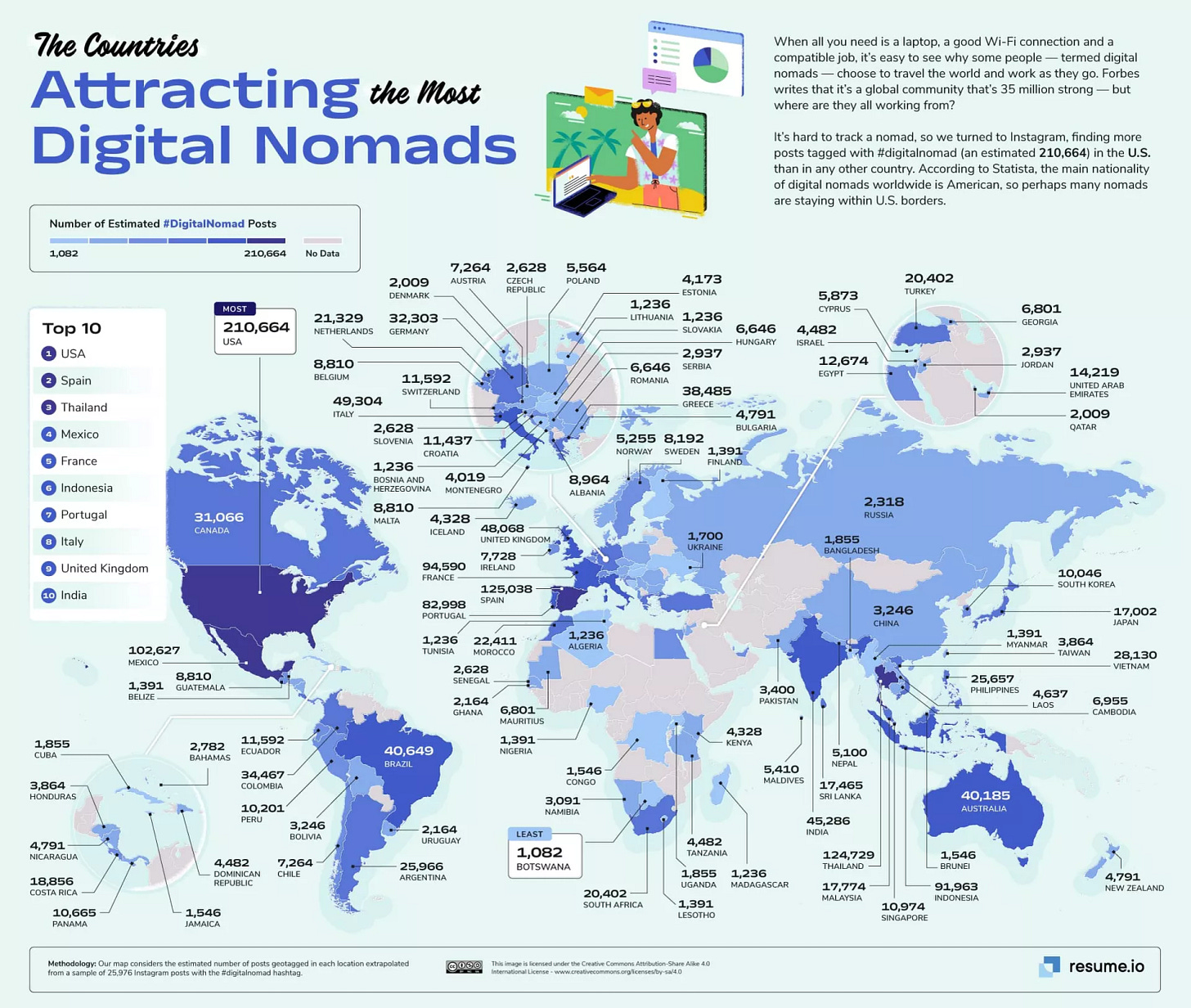

Across Europe, countries are quietly competing for remote workers. Since the pandemic, digital nomad visas have shifted from being a curiosity for early adopters to a full-blown policy tool: a way to attract spending power without touching local labour markets, to keep small towns alive beyond August, and to rebalance societies that are ageing faster than they like to admit.

On paper, it all sounds wonderfully simple.

Work remotely. Live well. Move freely.

In reality, Europe remains what it has always been: a patchwork of borders, tax systems, exceptions and historical compromises. Understanding that patchwork is what makes the difference between a pleasant year abroad and an administrative obstacle course.

So before diving into the individual visas, it’s worth setting the scene properly.

Three things you really need to understand first

The first is conceptual. Europe is not a single legal space.

“Europe”, “EU” and “Schengen” are three overlapping but very different ideas. The EU is about citizenship, labour law and political integration. Schengen is about borders and movement. Europe is just geography. Some countries sit in all three circles, some only in one, some in none. And your experience as a digital nomad depends far more on Schengen than on how European a place feels on Instagram.

The second point follows naturally: there is no such thing as a European digital nomad visa. Every visa is issued by one country, under its own rules. If that country is part of Schengen, you gain a useful bonus: the ability to travel short-term across the Schengen area (90 days in any 180). But that’s all it is — a travel privilege, not the right to live or work elsewhere.

The third point is the one most people underestimate. Remote work almost never means local integration. Across Europe, digital nomad visas are carefully designed to avoid friction with domestic labour markets. Income must come from abroad. Local work is almost always forbidden. And after 183 days, tax residency often enters the conversation whether you like it or not.

Once you accept these rules, the system becomes much easier to read.

The visas, country by country

What follows isn’t a ranking or a beauty contest. It’s a practical tour of Europe’s digital nomad landscape, with key data and direct links to official programmes — because in this field, sources matter.

Albania

Albania sits outside both the EU and Schengen, and makes no attempt to hide it.

Its Unique Permit allows remote workers to stay for one year, renewable up to five, with a surprisingly low income requirement of around €9,800 per year. Applications go through the national e-services portal:

https://e-albania.al

It’s affordable, friendly and increasingly popular — but choosing Albania means consciously opting out of European mobility. You’re there to stay, not to roam.

Bulgaria

Bulgaria, by contrast, is both EU and Schengen — but with a twist.

Its digital nomad framework offers one year of residence (renewable once) and requires an income of roughly €31,000 per year. Applications are handled by the Ministry of Interior:

https://www.mvr.bg

It’s one of the cheapest Schengen bases in Europe, yet paradoxically one of the stricter ones financially.

Croatia

Croatia remains one of the clearest and most readable options on the continent.

Its temporary stay for digital nomads lasts one year, is non-renewable, and requires around €2,500 per month in income. Applications go through the Ministry of Interior:

https://mup.gov.hr

Add Schengen access and a current exemption from local income tax, and it’s easy to see why Croatia keeps coming up in serious conversations.

Cyprus

Cyprus often confuses people because it’s an EU country that is not part of Schengen.

Its digital nomad visa runs up to three years, requires €3,500 per month, and is managed by the Civil Registry and Migration Department:

https://www.moi.gov.cy

You get EU life, sunshine and English-friendly bureaucracy — but no automatic mobility into mainland Europe.

Czech Republic

The Czech Republic doesn’t really offer a classic digital nomad visa. Instead, it relies on its long-standing Živno freelance licence.

The permit lasts up to one year and requires proof of funds (around €5,000). Applications are handled by the Ministry of the Interior:

https://www.mvcr.cz

It works well for people planning semi-local freelance activity, less so for pure location-independent work.

Estonia

Estonia was one of the first European countries to formalise remote work.

Its Digital Nomad Visa allows one year of stay (with a possible six-month extension) and requires €4,500 per month in income. Applications go through the Police and Border Guard Board:

https://www.politsei.ee

Everything is clear, digital and efficient — including the fact that tax residency applies after 183 days.

Finland

Finland’s approach is typically minimalist.

The self-employment residence permit lasts six months, requires €1,220 per month, and is managed by the Finnish Immigration Service:

https://migri.fi

It’s short, strict and transparent. No illusions, no surprises.

Greece

Greece offers a one-year digital nomad visa, extendable, with an income requirement of €3,500 per month.

Applications go through the Ministry of Migration or consulates:

https://migration.gov.gr

The rules are straightforward: remote work only, no Greek clients, and plenty of islands to test your discipline.

Hungary

Hungary’s White Card allows one year of stay, renewable, with a €3,000 monthly income requirement.

Applications are handled via

https://enterhungary.gov.hu

Tax exemption applies only for the first six months — a detail that becomes important faster than many expect.

Iceland

Iceland is not in the EU, but it is in Schengen — and it prices itself accordingly.

The remote work visa lasts six months and requires a monthly income of €7,075. Applications go through the Directorate of Immigration:

https://utl.is

It’s spectacular, expensive, and very honest about who it’s for.

Italy

Italy arrived late, but it did arrive.

Its digital nomad and remote worker visa became operational in 2024, lasts one year (renewable), and requires €28,000 per year in income. Applications go through official consular channels:

https://vistoperitalia.esteri.it

It’s promising, culturally irresistible — and absolutely not a visa to approach without tax planning.

Latvia

Latvia’s digital nomad visa is still being refined.

Income requirements sit at €2,858 per month, and applications are handled by national migration authorities:

https://www.pmlp.gov.lv

It’s quietly positioning itself as a long-term settlement option rather than a quick nomad stop.

Malta

Malta’s Nomad Residence Permit lasts one year, renewable, with a €2,700 monthly income requirement.

Applications go through Residency Malta Agency:

https://residencymalta.gov.mt

Tax treatment remains a moving target, which makes Malta attractive — but also one to approach carefully.

Montenegro

Montenegro offers up to two years of stay with a relatively low income threshold of about €1,400 per month.

Applications go through government channels:

https://www.gov.me

It’s affordable and scenic, but firmly outside Europe’s mobility core.

Norway

Norway’s independent contractor permit allows up to two years of residence with a €3,000 monthly income requirement.

Applications are managed by UDI:

https://www.udi.no

The catch? You need at least one Norwegian client — and you’ll be paying Norwegian taxes.

Portugal

Portugal’s residence visa for remote activity replaced the informal use of the D7.

It lasts one year, requires €3,280 per month, and is managed by AIMA and consulates:

https://aima.gov.pt

Clearer now, but less generous than it once was.

Romania

Romania offers one of the most interesting tax setups.

The digital nomad visa lasts one year, requires €3,950 per month, and applications go through:

https://igi.mai.gov.ro

If you stay under 183 days, you remain outside Romanian tax residency — a detail many planners appreciate.

Slovenia

Slovenia’s visa lasts 12 months, is non-renewable, and requires around €3,200 per month.

Applications go through national authorities:

https://www.gov.si

A mandatory six-month exit before reapplying makes it a deliberate, time-boxed choice.

Spain

Spain’s digital nomad visa, introduced under the Startup Law, is the most politically ambitious of the bunch.

It allows residence for up to five years, requires €2,334 per month, and offers a 15% flat tax rate for qualifying incomes. Applications go through UGE and consulates:

https://www.inclusion.gob.es

Spain isn’t just welcoming nomads — it’s trying to anchor them.

Türkiye

Türkiye sits outside both the EU and Schengen, and embraces that position.

Its digital nomad visa lasts six months, requires €2,800 per month, and comes with age limits (21–55). Applications start here:

https://digitalnomads.goturkiye.com

Big cities, strong culture, limited European mobility.

A more honest conclusion

Europe isn’t becoming borderless. It’s becoming selectively open.

Digital nomad visas aren’t about freedom in the abstract. They’re about controlled access: attracting income, skills and spending without rewriting domestic rules. Once you see that, the system stops looking contradictory and starts looking intentional.

Choose a visa for the scenery and you’ll struggle.

Choose it for mobility, taxation and legal structure, and Europe still offers an extraordinary range of ways to live and work well.

The trick is remembering that legal Europe and romantic Europe are rarely the same place — and planning accordingly.

Excellent post with great info. Thankyou🙏